Politinomics

Truncating complex economic variables.

The big question on everyone’s mind right now is ‘are we heading into a bad economy?’. This motif has dominated many of our conversations lately. Coincidentally, it seems to have correlated with an uptick in media clips with captions like “trade war” and “chainsaw”.

Hey, if it bleeds, it leads. Meanwhile, the torrent of Amazon deliveries continues unabated and there's still a one hour wait for Sunday brunch.

The Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary yesterday with total nonfarm payroll numbers increasing by 151,000. This is slightly below the estimate of 160,000 but reflective of a resilient job market. But what the survey giveth, the revisions taketh away. Be prepared.

The finger-pointing cynics with an affinity for data analytics and bad hygiene will also point to discrepancies in the Household survey. The reading suggests not all is well in the labor market, reporting a fall in employment of -588,000.

With only 60,000 households surveyed, it is notoriously volatile. But it could hint at a massive shift in the jobs market. The world’s largest employer is the US Federal government and there have been rumors of cost cutting measures. Trusting this survey is like trusting information from your cousin with questionable connections – they just may be right.

Not to be outdone, the tariff sparing continues to hog the spotlight as the nation’s top primate attention bait. In fairness, it is a big deal for the 2025 economy. Few can argue that the application of tariffs will lead to immediately positive outcomes. There are better arguments for kissing your wife after correcting her. More tariffs are coming which will weigh on markets.

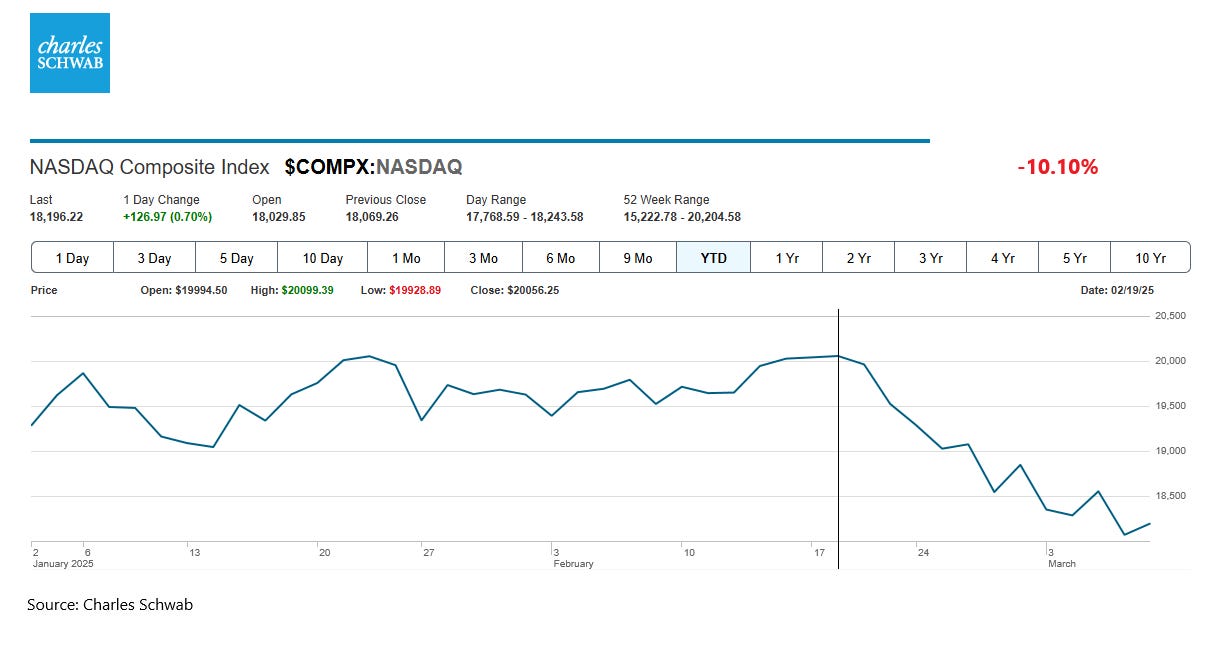

Major US market indexes such as the NASDAQ, Russell 2000 and S&P 600 have already crossed into a correction, which is defined as a decline of 10% or more from a high. The S&P 500 has fared a little better with a –7% decline from its recent peak. A reasonable move considering rich valuations and mounting uncertainty.

Like a day that just can’t seem to end, yet more volatile news crowds our awareness as attempts are made to settle the violent conflict in Ukraine. Get it wrong and that could reignite the infamously unstable European powder keg, again, this time with new and improved fireworks.

The perfect complement to this stew of fear and loathing is the serious notion that anyone with a job will be required to rapidly adapt to silicon-based neural networks to keep relevant enough to earn. Many don’t even know what this means, which only adds to the anxiety.

The human mind has not evolved to process this volume of high-stakes variable input. Decision making is a complex interplay of cognitive heuristics, memory and emotions optimized for pattern recognition with limited data sampling. Researchers suggest we make decisions on a set of only 4 – 7 factors1. When overwhelmed by consequential data, we flip the game board and stomp off to our rooms.

This is what’s happening right now. Many find solace in political ideologies due to the simplicity of the framework – love this, hate that. This in turn creates more uncertainty as tensions rise. Jittery ‘investors’ are moving to cash because it reduces perceived complexity, not because it’s thoughtful. These are the trademarks of a reactionary.

I expect temperatures to rise before they cool. This is the heat generated by the friction of change. Not all the change is political. Much of it isn't. Not all of it is negative. Most of it isn’t.

We could see asset prices deteriorate in the near term as reactionaries scramble for simplicity and others speculate on preemptive advantage. In fact, I am fully expecting this. The panic of the herd can stampede without even knowing why. The individual only knows that his neighbor is stampeding.

The herd will eventually come to its senses and come back to where the grass is green. I suggest keeping your wits about you and conserving your energy. Stay invested in a sensibly allocated portfolio and understand that downturns will happen without your ability to time them.

If you cannot sleep soundly, call your financial professional to revisit your strategy.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The NASDAQ Composite Index measures all NASDAQ domestic and non-U.S. based common stocks listed on The NASDAQ Stock Market. The market value, the last sale price multiplied by total shares outstanding, is calculated throughout the trading day, and is related to the total value of the Index.

The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell Index.

The S&P Small Cap 600 Index is an unmanaged index generally representative of the market for the stocks of small capitalization U.S. companies.

Securities offered through LPL Financial LLC. Member FINRA/SIPC. Advisory Services offered by National Wealth Management Group LLC, an SEC Registered Investment Advisor and separate entity from LPL Financial.

Judgment and Decision Making (2010)